A cent lower. A world of difference.

Institutional traders turn to Forge Pro for valuable private market data. But with large trading volumes at stake, coming in at even a cent too high can mean opportunity missed. Forge wasn’t just leaving money on the table—it was failing to meet traders where they are.

Role:

Senior Product Designer

Platform:

Web

Goal:

Features guided by user research.

01. THE SITUATION

Failing to capture the market

Although Forge Pro had seen increasing usage, it was failing to create a digital revenue stream.

Since Launch (02/24 - 01/25)

▼$44M

Transaction volume < Hiive*

17%

Bid/ask submission**

▲198

New users

▲75%

Logins***

Most users just sign in to look at a company’s page and then leave.

The OLD company page:

*Hiive’s claim to pull ahead in the market. Hiive at $214M and Forge at $170M in transaction volume in December, 2024.

** Users would submit IOIs via the form. An Indication of Interest (IOI) is a preliminary, non-binding expression of intent to buy or sell securities, serving as a precursor to the transaction process.

*** Distinct user logins per month increased by 75% comparing the month of February to December.

**** There were 4 times as many company page views compared to the next most viewed page.

4x

Company views****

75%

Users don’t scroll

02. THE TASK

Empathize

I did continuous user research to ensure alignment with user needs.

Synthesis

Synthesis of qualitative research to identify themes.

Workshops

Cross-functional collaboration to identify insights and opportunities.

Competitor research

Analysis and benchmarking of similar products.

Trader’s Journey Workshop

I facilitated a workshop with the PDE team supporting Forge Pro, alongside additional designers and engineers who expressed interest. Together, as a cross-functional team, we analyzed the user journey, identified pain points, and uncovered opportunities for improvement.

The team identified two pain points being most painful “falling behind, unactionable data” and “waiting to get a response on my interest”.

Key themes

Notifications

Play a critical role across all stages of the user journey, helping users reengage at the most productive moments while minimizing wasted time.

IOI Nuance

Enhancing transparency and data accuracy to build trust in the platform and deliver more actionable insights for users.

Customization

Empowering users to tailor their experience, ensuring it aligns seamlessly with their unique strategies.

Automation

Streamlining the submission and management of interests to minimize the time required for users to take action.

Simplification

Eliminating unnecessary roadblocks in the experience to enable traders to operate as quickly and efficiently as they desire.

Self-service

Empowering users to independently understand the market and manage their IOIs, reducing reliance on brokers.

Faster price discovery

One of the trader's primary objectives—quick and efficient access to pricing insights.

In-app negotiation

Accelerating transaction timelines by enabling users to negotiate directly within the platform.

03. THE OUTCOME

Streamlining

I designed a new experience that removed roadblocks and showed users the data that they were after.

Increasing actionability

The product updates addressed users’ desires for self-service and actionability by giving more visibility to offerings.

ITERATION ONE: Faster to build. Referenced existing code from consumer-facing product.

ITERATION TWO: Longer to build. A tabular format catering to the rich data preferences of institutional traders.

Clarifying the big picture

The dashboard unified market level information into one location. This simplified the understanding of what was happening at a higher level on Forge’s market.

Existing charts

Forge Pro had a number of existing charts scattered across different areas of the experience which were:

Atypical

Gawky

Obscure

New charts

Presented data in a familiar and consistent way. These simple charts allowed users to quickly gather market information and be on their way.

Showing people what they want to see

By elevating crucial pricing data on company pages the new design contributed to faster price discovery.

Version One

Version one showed all of the important pricing information people were looking for at the very top. It also introduced a sub nav which would help make the long page easier to navigate.

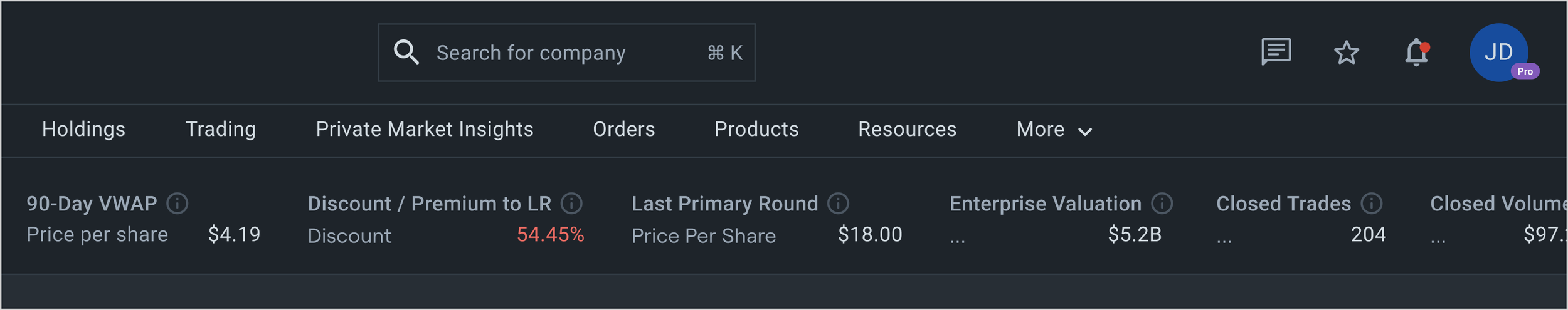

90-Day VWAP

An internal pricing metric which was based on the average price from the transactions over the last rolling 90 days.

Last round data

Last round data was a respected metric amongst institutional investors. However, it was very stale relative to the market.

Closed trade data

Considered to be very valuable as it indicated real behavior and sentiment of the market. Forge is considered a trusted player with a sizable share of the market.

Version Two

This kept the important updates from version one. It also further consolidated the space and brought the design in closer alignment with the design system.

Version Three

The final version shows important pricing info at the top, a more integrated sub nav and doesn’t sacrifice the watchlist functionality.

Liquidity score

Liquidity is especially important in private markets as transactions can be blocked by the Issuer. A ROFR can result in a significant loss of time and effort so traders were very interested in this.

Highest Bid / Lowest Ask

These numbers suggested the degree of spread in the market for the issuer. These could actually overlap at times due to lack of transparency in private markets. However, traders find these metrics fundamental to their process.