Chaos belongs on the trading floor, not in internal tools.

Forge brokers drive the company’s success, but their tools weren’t keeping up. Disjointed workflows and outdated systems slowed them down, creating friction where there should be flow. Instead of managing deals, brokers were managing inefficiencies. To fix this, Forge built streamlined, intuitive tools that let brokers focus on what they do best—trading, not troubleshooting.

Role:

Senior Product Designer

Platform:

Web

Goal:

Create designs for validation by our brokers

Impact

▲Efficiency

“I think this is brilliant frankly, this is the simplest solution of turning our IOIs into an inventory list to send to a client...I spend an hour doing that for one client.”

“Having a way to download and pop into an excel and pop that into an email would be very, very helpful. ”

1) Problem definition

I collaborated with other teams to understand key context and criteria.

Brokers

Existing workflows showed numerous applications in use and a largely manual process.

User Research

Research enforced broker needs such as “rich contextual data”.

Product

Prioritized revenue generating activity and broker workflows.

Engineering

Referenced the MUI library used by engineers.

Design

Referenced design principles, such as “elevate key statuses”.

The north star hypothesis:

Consolidation will lead to ▲Efficiency

Brokers used multiple tools to complete their daily tasks. This made them slow and led to a loss of opportunity.

▼ Overwhelming, confusing, slow

The old ways:

The new way:

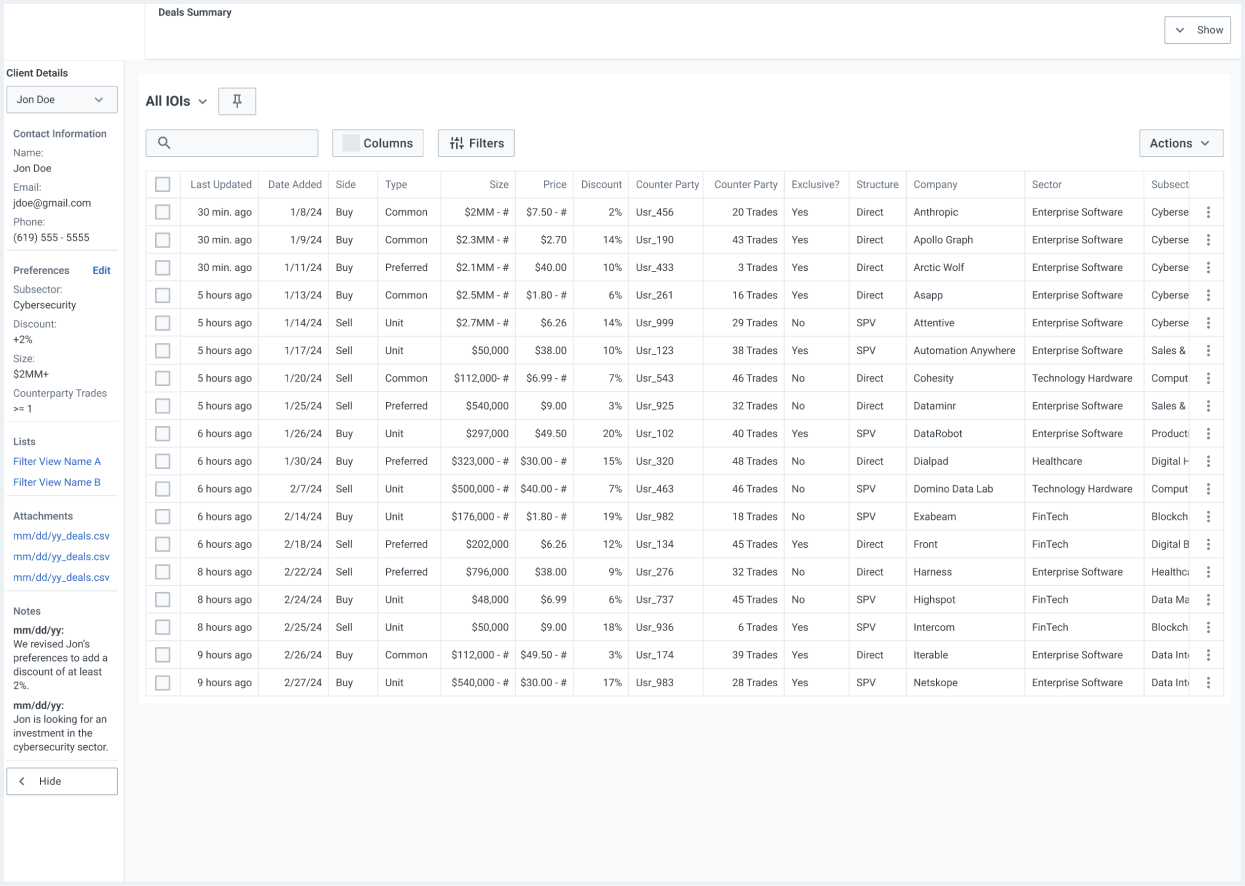

The new tool would allow brokers to perform daily tasks in one place. This decreased loss of opportunity.

▲ Streamlined, rich, fast

2) Achieving buy-in

ISOLATE USE CASES

Brokers look through every avenue to generate deal flow. It’s very helpful for them to know as much as possible.

Deal generation

Brokers would connect with a handful of clients every day to share important updates in the market.

Sharing market color

Brokers review a queue of existing IOIs to update or cancel.

IOI* Management

*An Indication of Interest (IOI) is a preliminary, non-binding expression of intent to buy or sell securities, serving as a precursor to the transaction process.

TELL A STORY

3) Broker feedback

“I think this is brilliant frankly, this is the simplest solution of turning our IOIs into an inventory list to send to a client...I spend an hour doing that for one client.” - Kyle, internal broker

“Having a way to download and pop into an excel and pop that into an email would be very, very helpful.” - David, internal broker

4) Synthesis

Likes

They liked the consolidated experience that made it easy to organize deals and share them with clients.

Questions

Questions arose around: how to manage updates, integrate the client CRM and incorporate third party data.

Decisions

We’d focus on: consolidation of IOIs, including organization functionality and to continue exploring IOI management.

5) IOI Management design refinement

Brokers needed to be able to view, create, update and cancel IOIs (indication of interest) on a daily basis. Initial designs needed more work to achieve buy-in.

ORIGINAL DESIGN

Explorations

Technical constraint primed iterations on different types of interactions that might suffice the core use cases for IOI management.

MODAL

MASTER DETAIL

MULTI MODAL

MODAL SHEET

SIDE PANEL

Dedicated view design explorations

The team decided to go with a dedicated view which would be the least technically complex option. I did a set of initial explorations on the visual design of the dedicated IOI detail page.

6) Final designs

The final designs enhanced clarity by highlighting key details, primary actions, and essential statuses. Brokers could also add notes to the history, allowing them to track and provide context for important status updates. Additionally, we introduced new content, including price comparisons, which proved invaluable for contextualizing potential updates.